It has been a challenging year in the housing market, and if you are considering buying a home, you are bound to be nervous about taking the plunge. Pulling together some of the latest insights, we delve into affordability, house prices, current trends and mortgages, giving home buyers some up to date information and context to help you make an informed decision regarding whether now is the right time to buy.

Property market update – house prices & number of sales

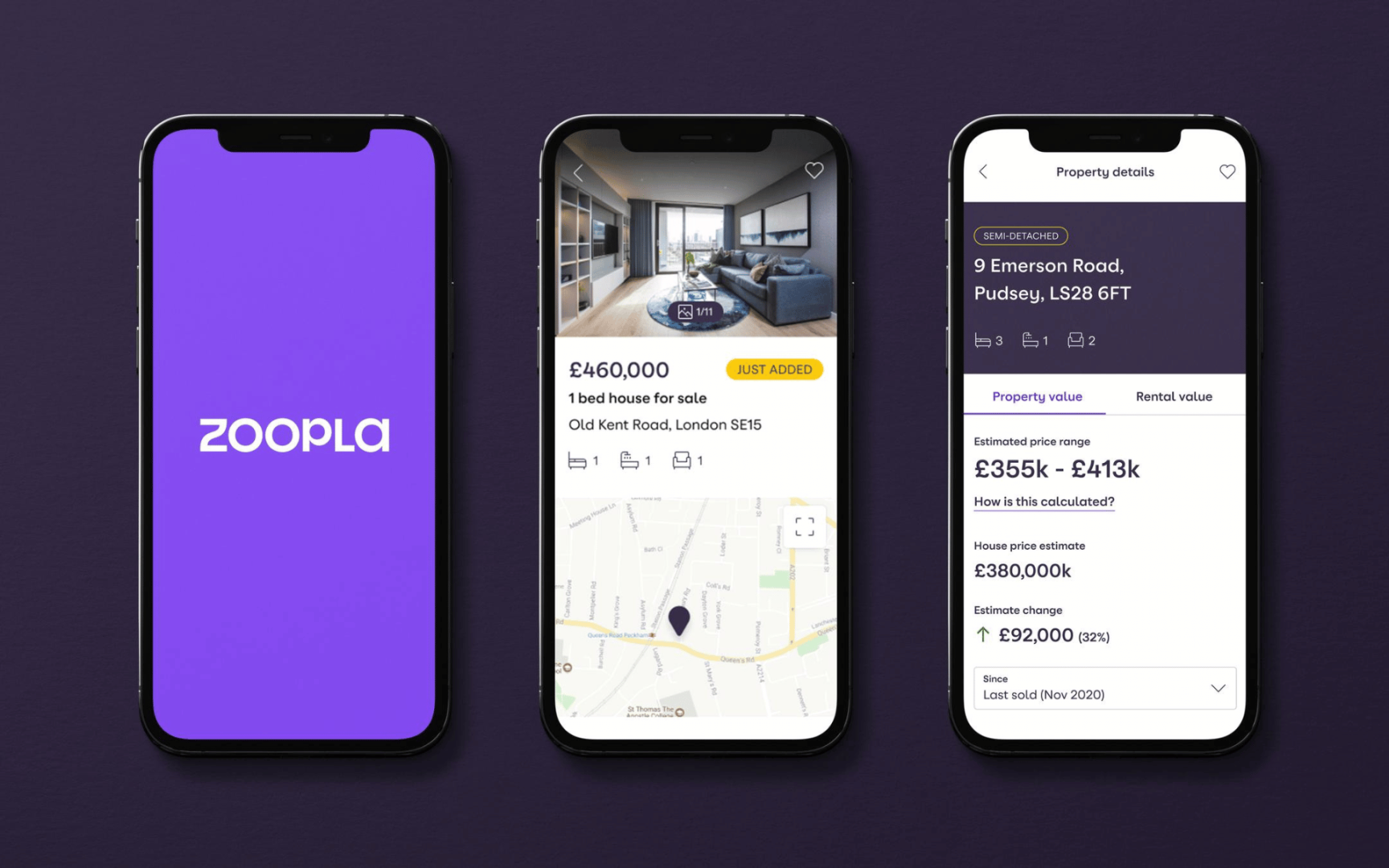

The UK housing market has seen a significant slowdown in house price growth in the last year, as well as a decrease in the number of sales. According to Zoopla's House Price Index, the number of homes being sold subject to contract is down 21% compared with last year, with this year set to have the lowest number of property sales since 2012. This significant decline highlights the deep impact of recent economic changes on the housing market.

The majority of this fall in sales can be attributed to buyers purchasing with a mortgage, with the number of mortgaged sales expected to drop by 28% compared with last year. Homeowners with a mortgage typically account for a third of annual property sales – when rates are relatively high those buyers who are able are less inclined to move, and will wait for mortgage rates to improve.

What is affordability, and why is it important?

Home affordability is measured by comparing average income levels with house prices, and the good news is that affordability is improving. Average wage rises of 7% over the last year while house prices fell modestly has improved housing affordability, even when higher mortgage rates are taken into account. With this narrowing of the gap between house prices and earnings, affordability is expected to improve by 9–10% over 2023, which is set to result in the UK house price to earnings ratio being 6.3x by the end of the year, making buying a house as affordable as the average over the last 20 years.

While activity in the housing market may remain subdued in the near term, Nationwide's latest House Price Index report offers hope that a relatively soft landing is still achievable. The report also indicates that affordability could further improve, with a mix of income growth and lower house prices, if mortgage rates cool. Robert Gardner, Nationwide's chief economist, expects unemployment to remain low (below 5%), and the vast majority of existing borrowers should be able to weather the impact of higher borrowing costs, given the high proportion of mortgage holders with a fixed rate loan, and with affordability testing ensuring that those needing to refinance can afford the higher payments.

Factors affecting first-time buyers

First-time buyers constitute one third of annual house purchases, and their ability to afford mortgages can have a significant impact on the property market. Given that the majority of first-time buyers are transitioning from rented accommodation, a key factor considered by a first-time buyer when deciding when to buy is the affordability of renting vs. buying. In recent years, low mortgage rates made purchasing more economical than renting on a monthly basis, which led to a surge in first-time buyers, including many purchasing larger 3+ bedroom homes. However, with mortgage rates at 5% or higher, renting is now typically 10% cheaper than buying, which has reduced the number of first-time buyers in the marketplace and consequently limited house price growth.

Looking ahead

In the next 2 to 3 years, property sales are expected to bounce back due to factors such as flexible work arrangements, demographic shifts in an ageing population, a strong labour market and high immigration rates, all of which will encourage more people to move house. Although mortgage rates are gradually falling and may drop below 5% later this year, it will be a slow process that depends on financial markets assessing the necessary interest rates to control inflation. Therefore, any changes in mortgage rates may not impact the market or improve affordability significantly until the first half of 2024 or beyond. Due to this uncertainty, house price growth is likely to remain within a range of +2% to -2% for the foreseeable future.

So is it a good time to buy?

In short, yes! We have transitioned to a buyer’s market here in West Devon, with more homes on the market and prices starting to decrease from the artificial highs during the pandemic. If you are able to secure financing or are purchasing with cash, you will be in the advantaged position of being able to snap up a great property at a competitive price, allowing ample opportunity for value growth in the 5-7 year timeframe. It’s also a great time to upsize, as when prices fall by a given percentage, higher priced homes with fall more in terms of pounds sterling than lower priced homes.

If you’d like to hear more details about what’s going in our local West Devon property market, call our team today for a friendly chat – 01822 617243 (Tavistock) or 01837 54080 (Okehampton).

By

By

by

by

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link